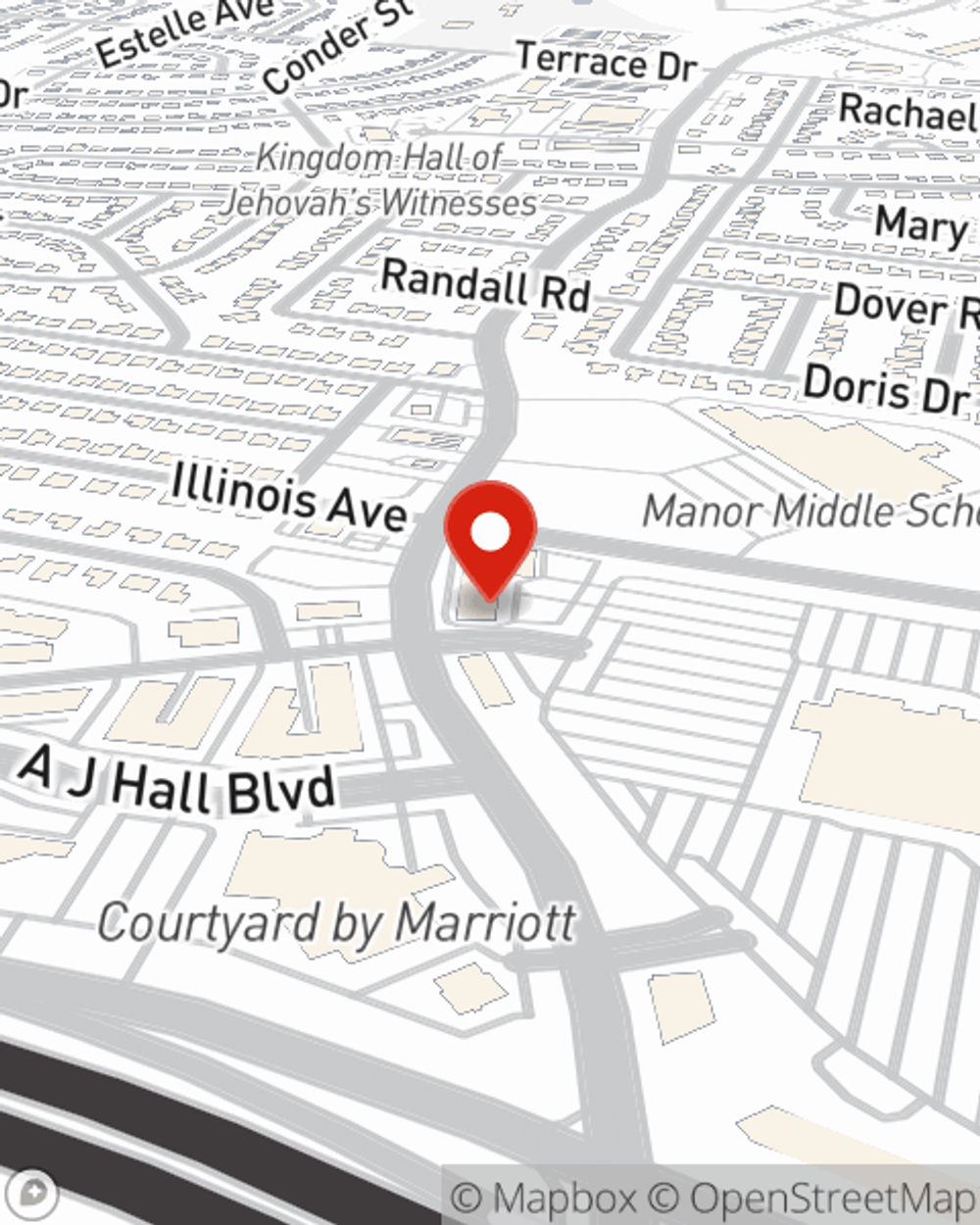

Homeowners Insurance in and around Killeen

Looking for homeowners insurance in Killeen?

Give your home an extra layer of protection with State Farm home insurance.

Would you like to create a personalized homeowners quote?

- Killeen

- Belton

- Harker Heights

- Copperas Cove

- Nolanville

- Temple

- Salado

- Waco

- Austin

- Round Rock

- Georgetown

- Texas

- Bell County

- Travis County

- Williamson County

- Oklahoma City

- Norman

- Edmond

- Guthrie

- Wynnewood

- Duncan

- Lawton

- Weatherford

- Midwest City

Home Sweet Home Starts With State Farm

It's so good to be home, especially when your home is insured by State Farm. You never have to be uneasy about the unpredictable with this outstanding insurance.

Looking for homeowners insurance in Killeen?

Give your home an extra layer of protection with State Farm home insurance.

Don't Sweat The Small Stuff, We've Got You Covered.

Navigating the unexpected is made easy with State Farm. Here you can create a plan that's right for you or submit a claim with the help of agent Kalynn Tindall. Kalynn Tindall will make sure you get the personalized, excellent care that you and your home needs.

Ready for some help exploring your specific homeowners coverage options? Call or email agent Kalynn Tindall's team for assistance today!

Have More Questions About Homeowners Insurance?

Call Kalynn at (254) 634-3590 or visit our FAQ page.

Protect your place from electrical fires

State Farm and Ting* can help you prevent electrical fires before they happen - for free.

Ting program only available to eligible State Farm Non-Tenant Homeowner policyholders

Explore Ting*The State Farm Ting program is currently unavailable in AK, DE, NC, SD and WY

Simple Insights®

Be aware of electrical hazards in your home

Be aware of electrical hazards in your home

Electricity presents a real danger and can cause extensive damage to your property. Consider these electrical safety tips for your home.

Weatherproofing: how to prepare for a heat wave

Weatherproofing: how to prepare for a heat wave

As the summer approaches, it’s critical to consider how to prepare for extreme heat. We’ll discuss heat safety tips for your home and vehicle.

Kalynn Tindall

State Farm® Insurance AgentSimple Insights®

Be aware of electrical hazards in your home

Be aware of electrical hazards in your home

Electricity presents a real danger and can cause extensive damage to your property. Consider these electrical safety tips for your home.

Weatherproofing: how to prepare for a heat wave

Weatherproofing: how to prepare for a heat wave

As the summer approaches, it’s critical to consider how to prepare for extreme heat. We’ll discuss heat safety tips for your home and vehicle.